Key Reasons to Invest:

- AP’s Mundra Port and Indian operations are excellent infra assets with Revenues, EBITDA and Profits up by 36%, 32% and 50% CAGR over the last 5 years.

- AP can emerge as a port sector dominator in 3-4 years. The currently govt. dominated Indian Port sector is constrained on capacity and efficiency, offering a large opportunity.

- Divestment of the Abbot Point Port, Australia has de-risked the business.

- It has only medium debt, and the cash flow is likely to improve in coming quarters.

- Risk: Environmental review and SEZ clearances by Govt. of India.

This is an update of my Sept 2012 report ‘Adani Port – The Great Australian Adventure’ available here.

Adani Port – Description and Profile

- Adani Port and SEZ – (AP) is Gujarat based firm with FY13 revenues 3841 cr and PAT 1639 cr (consolidated).

- The Founder/Chairman of AP is Gautam Adani, a self-made entrepreneur.

- AP businesses include Mundra Port, the largest private port – 82mmt in FY13, an adjacent SEZ area of 6,500-hectare and several terminal operating contracts at other Ports in India. (mmt is million metric tonnes Cargo)

- Mundra Port was #2 among Indian ports in FY13, with a 15% market share, and has become #1 this year. It trades in a diverse cargo base like bulk, liquid, project cargo and container, implying lower business risks.

- It’s a private port, so Mundra is free to price its services, unlike the PSU ports in India. It has ‘take or pay’ arrangements with many of the customers. This protects AP from sudden drops in demand.

- AP is also developing and operating terminals at Hazira, Mormugao, Dahej, Hazira, Kandla and Vizag in India. AP as an operator now has a presence in seven ports in India.

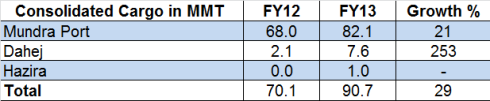

- Connectivity and logistical facilities connect the Port, berthing and storage facilities to Roads, Rail, Airstrip and Pipelines for goods transportation. Growth in Cargo was 29% in FY13. See Exhibit 1.

- The Shareholding in % is Promoters 75.0, MFs/DII 5.1, FIIs 15.0, Individuals retail/HNI 3.1 and Others 1.8.

- Adani Enterprises is the holding company with cross-holdings in Adani Power and AP. The group is focused on sectors of Coal, Mining, Port Logistics and Power generation, and the three firms execute on this plan.

- The vision for AP is to increase annual cargo handling capacity from 91 mmt in 2013 to 200 mmt by 2020.

Events, News and Strategies

- In Q1FY14 Mundra Port overtook Kandla to emerge as India’s largest port by handling 24 mmt (Kandla 23).

- The Abbott Point Port, Australia was acquired by AP in June 2011. But in Mar 2013, it was divested to its promoters, freeing AP of a complex foreign asset and large debt, so it can concentrate on Indian operations. Post a valuation exercise, the entire debt and equity used for this purchase was bought out.

- In early May, the Union government granted security clearance to AP, thereby allowing the firm to participate in port/ terminal bids, removing a restriction that was placed on it in November 2010.

- Tata’s Mundra UMPP and Adani Power obtained approval from the CERC for a revision of power tariff due to rising imported coal costs. This coal is routed through Mundra Port.

- Adani Group is exploring a listing of holding company Adani Enterprise on an overseas bourse, to raise cash and help reduce debt at a group level. If this succeeds, it will trigger a price appreciation.

- The promoters of AP recently reduced stake to SEBI specified 75%, raising 1,000 cr via Institutional placement.

- New Projects: Possible investments include the Dharma Port, a new port on the East coast. This high potential port has the deepest draft and cargo capacity of 25mmt in place, with a long term expansion plan to 100mmt.

- Tie ups with Maersk and Mediterranean Shipping Co. (MSC), the world’s top container shipping lines should help increase cargo volumes in Mundra. Ports assets at Hazira and Dahej will see full utilisation from FY14.

Industry Note:

- 95% of India’s international trade is done through the Sea Ports. Traffic projections for next 8 years are 11% growth CAGR (Shipping Ministry). As Imports and Exports grow rapidly, the constraint will be Port capacities.

- Mundra Port is able to provide port access to industries in Gujarat, Maharashtra and North Indian regions. It has an excellent location and the connectivity has been well developed.

- The Central govt. Ports are constrained in terms of low tariffs; and terminal operators are not incentivized to grow volumes, resulting in stagnant capacities and falling market share. Most of the major ports are operating near the full capacity, resulting in high per-berthing detention and turnaround time of vessels.

- Ports capacity needs to be increased for better service and operations. This is a big opportunity for AP.

Stock Valuation, Performance and Returns

- The IPO of AP in Nov 2007 was successful. It was oversubscribed 115 times, and provided listing gains. However it was aggressively priced, at 88 (Rs, adjusted). See Fig 2.

- There was a split in Sept 2010, from FV10 to FV2.

- IPO investors have seen a 6% CAGR returns since listing. The Dividend has increased steadily, till the current 50%, i.e. Re 1 on FV Rs 2. This gives a dividend yield of 0.8%.

- Volatile Prices – Share price rose post IPO to 264, fell to 50 in Nov’08, rose again to a high of 185 in Oct’10, before dropping to today’s 131.

- The 5 year growth has been rapid, with Revenues, EBITDA and Profits up 36%, 32% and 50% CAGR, Fig 3.

- With higher volumes, the margins have reduced, so Operating Margins are 64% and PAT Margins are 28%.

- Debt-equity is 1.67, down from recent highs. This is fair for an infra company, Fig 4.

- All infra companies incur high initial investments to create the assets. This is true of AP, which has a medium Cash flow due to recent investments in new terminals and capacity expansions.

- EPS (adjusted) is up 45% CAGR in recent years.

- Fig 5 tracks the market price of AP against its P/E, ttm. The PE for AP has been in a range of 15-45 times over 5 years. But current PE of 14.3 is at low end of this range.

- The chart (Fig 6) plots the market price against the adjusted EPS over the period. EPS shows us a steady quarterly increase indicating stable business performance.

- Return Ratios are improving – ROCE is 13% (7.8% in FY12) while RONW is 25% (23% in FY12).

- Our calculation of the PEG is 0.47 (0.55 in FY12), which indicates an undervalued stock.

Benchmarking and Financial Projections

We have benchmarked AP with comparable leaders from other sectors, Exhibit 7:

It appears that AP valuations look rich; the Sales & Profits are steady; Low asset turnover; Return ratios are good, while debt is high, and Interest coverage is low. The explanation is that:

- AP has always been perceived as a pioneer/ leader, so it has had higher valuations.

- AP has large assets that can be exploited, so the SEZ land bank is a key asset that can be monetized.

- Acquisition of assets like Dharma Port may involve large investments but over time the Returns will improve.

Financial Projections:

Here are the 2 year financial projections for AP, Exhibit 8.

Note – The financial projections in my Sept 2012 report were actually exceeded by AP in FY2013 by Turnover – 28%, EBITDA – 53% and Profits – 13%, partially due to the divesting of the Abbot Point asset, and rest due to overall excellent performance !! However, the share price is still not reflecting this.

Risks

- A panel set up by the Ministry of Environment and Forests (MoEF) to evaluate the firm against a PIL and complaints reports that AP flouted green norms. The possible result of this is a penalty/ fine that will be used to take corrective steps in the Mundra Port region.

- Certainly AP will have to modify its policies and ensure compliance in future.

- One of the criticisms of AP has been that this group is very aggressive, and in its push for growth and volumes ignores aspects like environment and safety systems and procedures.

- Gujarat High court in a May 2012 court order has stayed development work at AP due to unauthorized construction over a 1,840-hectare enclave that was not vacant, and had no Central environmental clearance – this may delay additional construction for the SEZ area.

- AP has reapplied for the SEZ status for this parcel of land.

- Outside the AP business, the Adani Group includes Adani Enterprises and Adani Power. As of now these two group entities have a troubled business outlook in terms of high debts, mining sector clampdowns, high costs of coal imports and poor financials. This may affect AP prospects directly or indirectly.

- In absolute numbers, AP consolidated debt is 10,600 cr (Mar 2013), of which 7,500 cr is in foreign exchange.

- As per reports, the forex debt is naturally hedged by marine/ container income, for interest & repayment.

Opinion, Outlook and Recommendation

- Seaports are very critical infrastructure for India. While imports have grown tremendously recently, we expect exports to also pick up and accelerate in the coming years. Almost 95% of merchandise Ex-Im is transported by seaports. The 5-9% GDP growth range in India is now testing the capacities of Indian Ports.

- Govt. ports so far have been constrained in terms of capacity, speed of execution and pricing.

- AP’s Mundra Port and other Indian operations are excellent. AP will capture market share due to investments in capacity, good connectivity, excellent facilities, speedier turnarounds and proximity to demand centers.

- AP is quickly emerging as a street smart and very aggressive competitor in the Port terminal construction and operation space, across cargo categories. With AP bidding for and setting up terminals even in PSU ports, AP in the next 3-4 years may be able dominate the sector. With large market share will come pricing power and better margins.

- With the exit from the Abbot Point Port, the EPS growth may continue in the high 40% for the next 3 years.

- The price has fallen 30% from the 175 peak in May 2013. PE has fallen to new lows. This provides a good entry point for long term investors.

- Investors may consider AP as a Medium Risk, High Gain stock. Our call is BUY with a 2 yr perspective.

Source: http://jainmatrix.com/2013/08/26/adani-port-aug-2013/

No comments:

Post a Comment